Williams County Sales Tax Extension

About the Sales Tax Extension

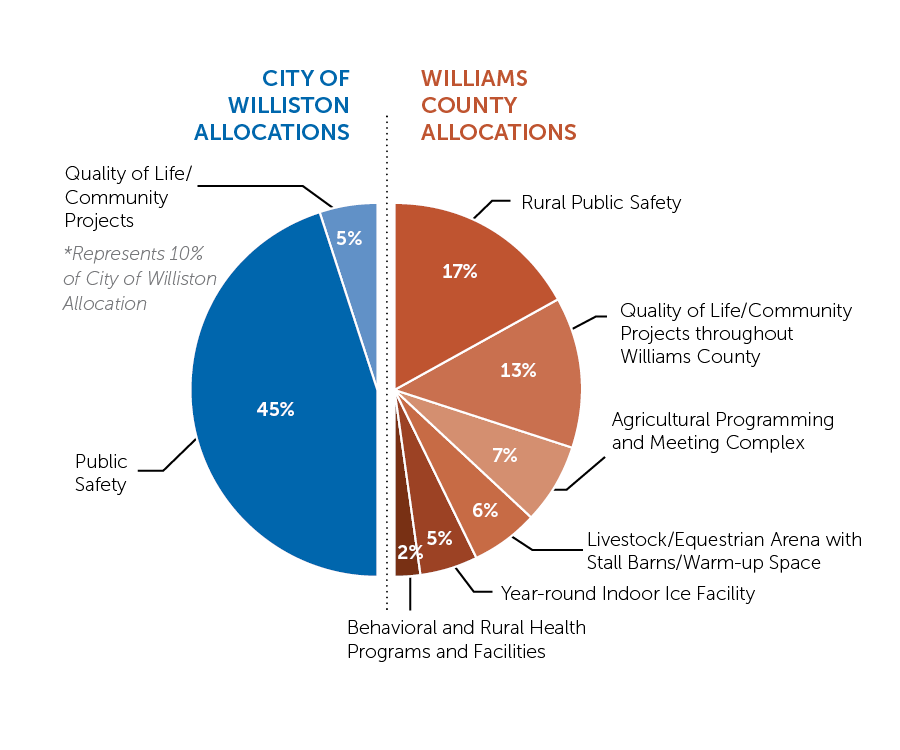

On the Primary Election ballot on June 11, 2024, electors affirmed an extension of the County's 1% sales tax (59% yes, 41% no) for an additional 10 years. Revenue is dedicated by Williams County and the City of Williston for three distinct purposes: (1) Public Safety, (2) Behavioral and Rural Health, and (3) Quality of Life. Sales tax collections began on April 1, 2025.

Beginning April 2015, Williams County collected a 1% sales tax, which was an essential revenue source for the 18 public safety agencies that serve visitors and residents of Williams County. Funds were also used to expand behavioral health services in an effort to reduce the impact on first responders and increase access to services in the County. The tax funded major building projects, provided for updated and new life-saving equipment and apparatuses, and closed the weather radar gap for northwestern North Dakota.

Estimated Sales Tax Distribution: April 2025 - March 2035

| Tax Purpose | Percentage | Est. Average Annual Revenue | Est. 10 Year Total |

| City of Williston | 50% | $12,000,000 | $120,000,000 |

| Public Safety | 45% | $10,800,000 | $108,000,000 |

Quality of Life

(10% of City's Allocation) |

5% | $1,200,000 | $12,000,000 |

| Williams County | 50% | $12,000,000 | $120,000,000 |

| Behavioral & Rural Health | 2% | $480,000 | $4,800,000 |

| Rural Public Safety | 17% | $4,080,000 | $40,800,000 |

| Quality of Life | 31% | $7,440,000 | $74,400,000 |

| Total | 100% | $24,000,000 | $240,000,000 |

Behavioral & Rural Health

With an extension of the sales tax, 2% of revenue will be dedicated to funding continued expansion of behavioral and rural health services. Williams County has built a foundation for enhancing behavioral health through the Williams County Behavioral Health Grant Program.

Rural Public Safety

If the sales tax is extended, Williams County will continue to contribute a portion of revenue (17%) to rural public safety agencies for operational and capital needs, including equipment replacement and training.

Quality of Life

In 2023, Williams County commissioned a Quality of Life Strategic Study to analyze the baseline inventory of current meeting/gathering/recreation spaces, evaluate local demand and execute a wider market analysis to understand facility utilization and operational sustainability, today and for the future. The Executive Summary provides information and insight into the process and future development opportunities. If the extension is passed, continued community input and collaboration will be needed to finalize project plans.

Between the City of Williston and Williams County, 36% of sales tax revenue will be dedicated to Quality of Life Projects:

| Project/Updates | Percentage | Avg. Annual | 10 Yr Total |

| Agricultural Programming and Meeting Complex | 7% | $1,680,000 | $16,800,000 |

| Livestock/Equestrian Arena with Stall Barns/Warm-up Space | 6% | $1,440,000 | $14,400,000 |

Year-round Indoor Ice Facility

|

5% | $1,200,000 | $12,000,000 |

| Community Projects throughout Williams County | 13% | $3,120,000 | $31,200,000 |

| Williams County Quality of Life Total | 31% | $7,440,000 | $74,400,000 |

| City of Williston Quality of Life | A minimum of $1 million will be allocated per year for indoor ice and convention space; a minimum of $200,000 will be allocated per year for community projects throughout the City of Williston. | ||

| City of Williston Quality of Life Total | 5% | $1,200,000 | $12,000,000 |

| Total Quality of Life | 36% | $8,640,000 | $86,400,000 |

*Note: Per ND Century Code 11-09.1-05.1, local sales tax dollars cannot be expended directly on School District infrastructure